- OS may soon become one of the largest cryptocurrency miners in the public markets based upon number of miners and daily revenues generated from mining.

- SOS will benefit from the advantages of reduced hydroelectric power in China.

- SOS may be the only publicly traded company that's mining Ethereum, the second largest cryptocurrency.

- SOS has stated plans to pioneer cryptocurrency financial services, including insurance and cryptocurrency loans, among other services.

- SOS has assembled a premier management team that has decades of experience on Wall Street and with U.S.-China publicly-traded corporate operations.

- The recent recapitalization of SOS will enable the company to achieve both of its stated goals of building revenues in its legacy business, while ramping up revenues in its newly entered cryptocurrency space.

In view of this substantial operational improvement for SOS, 300% YOY revenue growth for this microcap may be achievable for 2021 estimates. Factoring in the significantly reduced cost of energy from SOS's hydro-electric power generation deal, and the revaluation of SOS shares higher could become very significant.

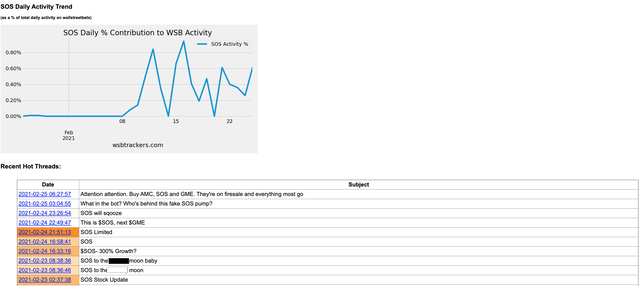

All of these exciting developments have not escaped the early notice of the WallStreetBets crowd on Reddit. SOS has begun to show up on the radar of the wsbtrackers.com. The graphic below indicates that SOS is on the WSB radar now, and gaining traction. We all know how important social media sentiment can be for a stock today. We also know that the recently increased short interest in SOS can be an attractive target for bulls who have performed proper due diligence on this SOS trade.

The bear thesis on this SOS short seems to be limited to the repetition of the falsehood that SOS is a Chinese scam. This is why I have gone to some lengths to introduce the management of SOS, as they each carry an impeccable resume of credibility, experience, and success on Wall Street and in China for decades. After reading the biographies/resumes of each of the key team members of SOS management, we can certainly put the falsehood of SOS being a "Chinese scam" to rest. SOS is a very solid, legitimate, and soon to be highly successful new entry into the cryptocurrency space.

It would make good sense for the WSB/Reddit crowd to target the short interest in SOS and ride this trade from the $6 range into the $20 range in the near term.

Longer term SOS is likely to accumulate some reasonable amount of Bitcoin, Ethereum, and launch its crypto financial services division, while also improving revenues from the legacy business. Perhaps 24 months out, we might deem it to be reasonable that the market cap of SOS could exceed the current market cap of RIOT and MARA combined. If this type of growth were to occur for SOS over the next 24 months, or so, then this very bullish valuation for SOS would assign a $10B market cap.

Longer term SOS is likely to accumulate some reasonable amount of Bitcoin, Ethereum, and launch its crypto financial services division, while also improving revenues from the legacy business. Perhaps 24 months out, we might deem it to be reasonable that the market cap of SOS could exceed the current market cap of RIOT and MARA combined. If this type of growth were to occur for SOS over the next 24 months, or so, then this very bullish valuation for SOS would assign a $10B market cap.

Although future offerings are likely for SOS, the current share count would trade at about $120 per ADS. Candidly, as you perform your due diligence and calculate valuations relative to SOS's peers in this crypto space, this bullish target for $120 is not unreasonable. Of course, if Bitcoin and Ethereum continue their volatile march to higher prices during the next 24 months, then increase the $120 price target for SOS accordingly. If these cryptos decline in price from current levels over the next two years, then reduce.

| SOS plans to mine both Bitcoin and Ethereum. SOS may be the first company to offer crypto insurance, crypto loans, and other crypto-related financial services in the months ahead. seekingalpha.com |

No comments:

Post a Comment